UNITED STATESSECURITIES AND EXCHANGE COMMISSIONWashington, D.C. 20549

SCHEDULE 14A

(RULE 14A-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant [X]

Filed by a party other than the Registrant [ ]

Check the appropriate box:

[X ]X] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

[ ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material under Rule 14a-12

GOLDEN QUEEN MINING CO. LTD.

(Name of Registrant as Specified In Its Charter)

N/A_______________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

| (1) | Title of each class of securities to which transaction applies: |

N/A | |

| (2) | Aggregate number of securities to which transaction applies: |

N/A | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth |

| the amount on which the filing fee is calculated and state how it was determined): | |

N/A | |

| (4) | Proposed maximum aggregate value of transaction: |

N/A | |

| (5) | Total fee paid: |

N/A | |

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | Amount Previously Paid: |

N/A | |

| (2) | Form, Schedule or Registration Statement No.: |

N/A | |

| (3) | Filing Party: |

N/A | |

| (4) | Date Filed: |

N/A | |

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD AT 10:00 A.M. ON DECEMBER <>, 2013

The Special Meeting of Shareholders of Golden Queen Mining Co. Ltd. (the “Company”) will be held at 10:00 a.m. (Pacific Standard Time) on Friday, December <>, 2013 at Suite 1200 - 750 West Pender Street, Vancouver, British Columbia, V6C 2T8, for the following purposes:

| 1. | To approve, by special resolution, the change in the authorized capital of the Company from 150,000,000 to an unlimited number of common shares, all without par value, and no preferred shares; and |

| 2. | To transact any other business which may properly come before the Meeting, or any adjournment or postponement thereof. |

The board of directors has fixed November 1, 2013, as the record date for determining shareholders entitled to receive notice of, and to vote at, the Meeting or any adjournment or postponement thereof. Only shareholders of record at the close of business on that date will be entitled to notice of and to vote at the Meeting.

All shareholders are invited to attend the Special Meeting in person, but even if you expect to be present at the meeting, you are requested to mark, sign, date and return the enclosed proxy card as promptly as possible in the envelope provided to ensure your representation. All proxies must be received by our transfer agent not less than forty-eight (48) hours, excluding Saturdays, Sundays, and holidays, prior to the time of the meeting in order to be counted. The address of our transfer agent is as follows: Computershare Trust Company of Canada, Proxy Dept., 100 University Ave., 8th Floor, Toronto, ON, M5J 2Y1. Shareholders of record attending the Special Meeting may vote in person even if they have previously voted by proxy.

Dated at Vancouver, British Columbia, this <> day of November, 2013.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ H. Lutz Klingmann

H. Lutz Klingmann

President and Director

Important Notice Regarding the Availability of Proxy Materials for

the Company’s Special Meeting of Shareholders on December <>, 2013.

The Company’s Proxy Statement is available online at www.goldenqueen.com

1

GOLDEN QUEEN MINING CO. LTD.6411 IMPERIAL AVENUEWEST VANCOUVER, BC V7W 2J5

PROXY STATEMENT AND INFORMATION CIRCULAR

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD SEPTEMBER 1, 2010DECEMBER <>, 2013

In this Proxy Statement and Information Circular, all references to “$” are references to United States dollars and all references to “C$” are references to Canadian dollars. As at July 28, 2010,November 1, 2013, one Canadian dollar was equal to approximately $<>$0.96 in U.S. Currency.

GENERAL

The enclosed proxy is solicited by the boardBoard of directorsDirectors (the “Board”) of Golden Queen Mining Co. Ltd., a British Columbia corporation (the “Company”"Company" or “Golden Queen”), for use at the Special Meeting of Shareholders (the “Meeting”) of Golden Queen to be held at 10:00 a.m. (Pacific Standard Time) on Wednesday, September 1, 2010,December <>, 2013, at the offices of Morton & Company,Law LLP, Suite 1200 - 750 West Pender Street, Vancouver, British Columbia, V6C 2T8, and at any adjournment or postponement thereof. References to “shares” in this document will mean common shares of the Company unless otherwise noted.

Our administrative offices are located at 6411 Imperial Avenue, West Vancouver, British Columbia, V7W 2J5. This Proxy Statement and the accompanying proxy card are being mailed to our shareholders on or about August 4, 2010.November <>, 2013. The Company is sending proxy-related materials directly to non-objecting beneficial owners under NI 54-101. Management of the Company does not intend to pay for intermediaries to forward to objecting beneficial owners under NI 54-101 the proxy-related materials, and in the case of an objecting beneficial owner, the objecting beneficial owner will not receive the materials unless the objecting beneficial owner’s intermediary assumes the cost of delivery.

The cost of solicitation will be bornepaid by the Company. The solicitation will be made primarily by mail. Proxies may also be solicited personally or by telephone by certain of the Company’s directors, officers and regular employees, who will not receive additional compensation therefore. In addition, the Company will reimburse brokerage firms, custodians, nominees and fiduciaries for their expenses in forwarding solicitation materials to beneficial shareholders.owners. The total cost of proxy solicitation, including legal fees and expenses incurred in connection with the preparation of this Proxy Statement and Information Circular, is estimated to be $12,000.$20,000.

Our administrative offices are located at 6411 Imperial Avenue, West Vancouver, British Columbia, V7W 2J5.

APPOINTMENT OF PROXYHOLDER

The persons named as proxyholder in the accompanying form of proxy were designated by the management of the Company (“Management Proxyholder”).A shareholder desiring to appoint some other person (“Alternate Proxyholder”) to represent him at the Meeting may do so by inserting such other person's name in the space indicated or by completing another proper form of proxy.A person appointed as proxyholder need not be a shareholder of the Company. All completed proxy forms must be deposited with Computershare Investor Services Inc. (“Computershare”) not less than forty-eight (48) hours, excluding Saturdays, Sundays, and holidays, before the time of the Meeting or any adjournment of it unless the chairman of the Meeting elects to exercise his discretion to accept proxies received subsequently.

EXERCISE OF DISCRETION BY PROXYHOLDER

The proxyholder will vote for or against or withhold from voting the shares, as directed by a shareholder on the proxy, on any ballot that may be called for.In the absence of any such direction, the Management Proxyholder will vote in favour of matters described in the proxy. In the absence of any direction as to how to vote the shares, an Alternate Proxyholder has discretion to vote them as he or she chooses.

12

The enclosed form of proxy confers discretionary authority upon theproxyholder with respect to amendments or variations tomatters identified in the attached Notice of Meeting and other matters which may properlycome before the Meeting.At present, Management of the Company knows of no such amendments, variations or other matters.

PROXY VOTING

Registered Shareholders

If you are a registered shareholder, you may wish to vote by proxy whether or not you attend the Meeting in person. Registered shareholders electing to submit a proxy may do so by completing the enclosed form of proxy (the “Proxy”) and returning it to the Company’s transfer agent, Computershare, in accordance with the instructions on the Proxy. In all cases you should ensure that the Proxy is received at least 48 hours (excluding Saturdays, Sundays and holidays) before the Meeting or the adjournment thereof at which the Proxy is to be used.

Beneficial Shareholders

The following information is of significant importance to shareholders who do not hold shares in their own name (referred to as “Beneficial Shareholders”). Beneficial Shareholders should note that the only proxies that can be recognized and acted upon at the Meeting are those deposited by registered shareholders (those whose names appear on the records of the Company as the registered holders of shares).

If shares are listed in an account statement provided to a shareholder by a broker, then in almost all cases those shares will not be registered in the shareholder's name on the records of the Company. Such shares will more likely be registered under the names of the shareholder's broker or an agent of that broker. In the United States, the vast majority of such shares are registered under the name of Cede & Co. as nominee for The Depository Trust Company (which acts as depositary for many U.S. brokerage firms and custodian banks), and in Canada, under the name of CDS & Co. (the registration name for The Canadian Depository for Securities Limited, which acts as nominee for many Canadian brokerage firms).

Intermediaries are required to seek voting instructions from Beneficial Shareholders in advance of shareholders' meetings. Every intermediary has its own mailing procedures and provides its own return instructions to clients.

If you are a Beneficial Shareholder:

You should carefully follow the instructions of your broker or intermediary in order to ensure that your shares are voted at the Meeting. The form of proxy supplied to you by your broker will be similar to the Proxy provided to registered shareholders by the Company. However, its purpose is limited to instructing the intermediary on how to vote on your behalf. Most brokers now delegate responsibility for obtaining instructions from clients to Broadridge Investor Communication Services (“Broadridge”) in the United States and in Canada. Broadridge mails a voting instruction form in lieu of a Proxy provided by the Company. The voting instruction form will name the same persons as the Company's Proxy to represent you at the Meeting. You have the right to appoint a person (who need not be a Beneficial Shareholder of the Company), other than the persons designated in the voting instruction form, to represent you at the Meeting. To exercise this right, you should insert the name of the desired representative in the blank space provided in the voting instruction form. The completed voting instruction form must then be returned to Broadridge by mail or facsimile or given to Broadridge by phone or over the internet, in accordance with Broadridge's instructions. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at the Meeting.If you receive a voting instruction form from Broadridge, you cannot use it to vote shares directly at the Meeting - the voting instruction form must be completed and returned to Broadridge, in accordance with its instructions, well in advance of the Meeting in order to have the shares voted.

2

Although as a Beneficial Shareholder you may not be recognized directly at the Meeting for the purposes of voting shares registered in the name of your broker, you, or a person designated by you, may attend at the Meeting as proxyholder for your broker and vote your shares in that capacity. If you wish to attend the Meeting and indirectly vote your shares as proxyholder for your broker, or have a person designated by you do so, you should enter your own name, or the name of the person you wish to designate, in the blank space on the voting instruction form provided to you and return the same to your broker in accordance with the instructions provided by such broker, well in advance of the Meeting.

3

Alternatively, you can request in writing that your broker send you a legal proxy which would enable you, or a person designated by you, to attend at the Meeting and vote your shares.

REVOCATION OF PROXIES

In addition to revocation in any other manner permitted by law, a registered shareholder who has given a proxy may revoke it by:

| (a) | Executing a proxy bearing a later date or by executing a valid notice of revocation, either of the foregoing to be executed by the registered shareholder or the registered shareholder’s authorized attorney in writing, or, if the shareholder is a corporation, under its corporate seal by an officer or attorney duly authorized, and by delivering the proxy bearing a later date to Computershare | |

| (b) | Personally attending the meeting and voting the registered shareholders’ shares. |

A revocation of a proxy will not affect a matter on which a vote is taken before the revocation.

Only registered shareholders have the right to revoke a Proxy. Non-Registered Holders who wish to change their vote must, at least seven days before the Meeting, arrange for their respective Intermediaries to revoke the Proxy on their behalf.

VOTING PROCEDURE

A quorum for the transaction of business at the Meeting is one person present at least two persons presentthe meeting representing in person being shareholders entitledor by proxy not less than 10% of the votes eligible to votecast at the Meeting or duly appointed proxies or representatives for absent shareholders so entitled.such meeting. Broker non-votes occur when a person holding shares through a bank or brokerage account does not provide instructions as to how his or her shares should be voted and the broker does not exercise discretion to vote those shares on a particular matter. Abstentions and broker nonvotesnon-votes will be included in determining the presence of a quorum at the Meeting. However, an abstention or broker non-vote will not have any effect on the outcome for the election of directors.

Shares for which proxy cards are properly executed and returned will be voted at the Meeting in accordance with the directions noted thereon or, in the absence of directions, will be voted “FOR” the approval, by special resolution, of the removal of Pre-existing Company Provisions (as defined in theBusiness Corporations Act (British Columbia), “FOR” the approval, by special resolution, of the adoption of new Articles of the Company, and “FOR” the approval, by special resolution, of the increase in the authorized capital of the Company from 100,000,000150,000,000 to 150,000,000an unlimited number of common shares, all without par value. It is not expected that any matters other than those referred to in this Proxy Statement will be brought before the Meeting. If, however, other matters are properly presented, the persons named as proxies will vote in accordance with their discretion with respect to such matters.

3

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

On July 28, 2010 (the “Record Date”) there were 94,078,380 sharesTo be effective, each matter which is submitted to a vote of our common stock (the “Common Stock”), issued and outstanding, each share carryingshareholders, other than for the right to one vote. Onlyapproval of auditors, must be approved by a majority of the votes cast by the shareholders of record at the close of business on the Record Date will be entitled to votevoting in person or by proxy at the Meeting or any adjournment thereof.Meeting.

To the knowledge of the Directors and executive officers of the Company, the beneficial owners or persons exercising control over Company shares carrying more than 5% of the outstanding voting rights are:

| Name and Address | Number of Shares(1) | Nature of Ownership | Approximate % of Total Issued |

| Landon T. Clay Providence, RI | 726,077 | Sole voting and investment control | 0.77% |

| 21,956,063(2)(4) | Shared voting and investment control | 23.34% | |

| Thomas M. Clay Providence, RI | 1,168,522(3) | Sole voting and investment control | 1.24% |

| 17,158,969(2) | Shared voting and investment control | 18.24% | |

| Harris Clay Augusta, GA | 4,797,094(4) | Shared voting and investment control | 5.10% |

| Soledad Mountain LLC Delaware | 7,258,330(5) | Sole voting and investment control | 7.72% |

| Sprott Asset Management Inc. Toronto, ON | 11,860,300(6) | Sole voting and investment control | 12.61% |

| Gammon Gold Inc. Toronto, ON | 7,500,000(7) | Sole voting and investment control | 7.97% |

| ||

| ||

| ||

| ||

| ||

| ||

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Except as disclosed herein, no Person has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in matters to be acted upon at the Meeting other than the election of directors and the appointment of auditors and as set out herein. For the purpose of this paragraph, “Person” shall include each person: (a) who has been a director, senior officer or insider of the Company at any time since the commencement of the Company’s last fiscal year; (b) who is a proposed nominee for election as a director of the Company; or (c)(b) who is an associate or affiliate of a person included in subparagraphssubparagraph (a) or (b).

4

PROPOSALVOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

On November 1,

REMOVAL OF PRE-EXISTING COMPANY PROVISIONS

Effective March 29, 2004, 2013 (the “Record Date”) there were 99,133,383 shares of our common stock (the "Common Stock"), issued and outstanding, each share carrying theBusiness Corporations Act (British Columbia) (the “Corporations Act”) replaced the previousCompany Act (British Columbia) (the “Old Act”). As a consequence, all British Columbia companies are now governed under the Corporations Act. Every British Columbia company must have transitioned right to the Corporations Act within two years from the coming into forceone vote. Only shareholders of the Corporations Act. The Company transitioned to the Corporations Act in 2005.

Under the Corporations Act certain Pre-Existing Company Provisions (the “PCPs”) continue to apply to the Company unless such provisions are removed by way of special resolution of the shareholders. Removal of the PCPs would permit the Company to adopt updated corporate articles that reflect current business practice under the Corporations Act.

The board of directors of the Company proposes to remove the PCPs. The removal of the PCPs requires the affirmative vote of not less than 75% of the votes castrecord at the Meeting by shareholdersclose of business on the Company, present in person or by proxy. Accordingly, the Company’s shareholdersRecord Date will be askedentitled to consider and, if thought advisable, to pass, with or without amendment, a special resolution as follows:

“BE IT RESOLVED, as a Special Resolution, THAT:

| ||

| ||

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE REMOVAL OF THE PRE-EXISTING COMPANY PROVISIONS.

5

PROPOSAL 2

ADOPTION OF NEW ARTICLES

The Company’s existing Articles (the “Existing Articles”) were implemented on May 30, 1986 pursuant to the Old Act. Since that time, a number of amendments have been made to the Corporations Act and certain corporate practices have evolved which are not reflected in the Existing Articles.

Accordingly, the Directors are recommending that the Company adopt a new form of Articles (the “Revised Articles”) to incorporate the provisions reflected in the amendments to the Act and to facilitate the Company being able to take advantage of certain mechanisms permitted by the legislation.

Key Provisions of Revised Articles

The following is a summary of certain key provisions contained in the Revised Articles that represent a change from the Existing Articles:

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

|

6

Shareholders may request a full copy of the Revised Articles by contacting the Company as indicated in the heading “Additional Information” below.

The resolution to adopt the Revised Articles must be passed by not less than 75% of the votes cast by the shareholders presentvote in person or by proxy at the Meeting. Accordingly,Meeting or any adjournment thereof.

To the Company’s shareholders will be asked to considerknowledge of the directors and if thought advisable, to pass, withexecutive officers of the Company, the beneficial owners or without amendment, a special resolution as follows:persons exercising control over Company shares carrying more than 5% of the outstanding voting rights are:

“BE IT RESOLVED, as a Special Resolution, THAT:

| Name and Address | Number of Shares(1) | Nature of Ownership | Approximate % of Total Issued |

| Landon T. Clay Providence, RI, USA | 30,777 | Sole voting and investment control | 0.03% |

| 17,436,581(2)(3)(4)(5) | Shared voting and investment control | 16.4% | |

| Thomas M. Clay Providence, RI, USA | 1,805,680 | Sole voting and investment control | 1.8% |

| 25,145,822(2)(3)(5)(6) | Shared voting and investment control | 23.6% | |

| Harris Clay Augusta, GA, USA | 7,258,330 | Sole voting and investment control | 7.3% |

| 13,419,029(4)(5)(6) | Shared voting and investment control | 13.5% | |

| Jonathan C. Clay Bronxville, NY, USA | 3,508,870(7) | Sole voting and investment control | 3.4% |

| 857,250(5) | Shared voting and investment control | 0.9% | |

| Sprott Asset Management LP Toronto, ON, Canada | 9,116,900 | Sole voting and investment control | 9.2% |

| H. Lutz Klingmann West Vancouver, BC, Canada | 829,100 | Sole voting and investment control | 0.8% |

| Bryan A. Coates Saint-Lambert, Québec, Canada | 50,000(8) | Sole voting and investment control | 0.05% |

| Guy Le Bel Repentigny, Quebec, Canada | 50,000(9) | Sole voting and investment control | 0.05% |

| Bernard Guarnera Broomfield, Colorado, USA | 50,000(10) | Sole voting and investment control | 0.05% |

| Andree St-Germain Vancouver, BC, Canada | 300,000(11) | Sole voting and investment control | 0.3% |

| Laurence Morris Morelos, Mexico | 300,000(12) | Sole voting and investment control | 0.3% |

| All Directors and Executive Officers as a Group | 28,530,602 | 26.68% |

The information relating to the | ||

| (2) | Landon T. Clay and Thomas M. Clay have shared voting and investment control of 6,896,509 shares. | |

| ||

| (4) | Landon T. Clay and Harris Clay have shared voting and investment control of 2,451,269 shares. | |

| (5) | Landon T. Clay, Thomas M. Clay, Harris Clay, and Jonathan C. Clay have shared voting and investment control of 807,250 shares. | |

| (6) | Thomas M. Clay and Harris Clay have shared voting and investment control of 10,160,510 shares. | |

| (7) | Includes 2,427,184 shares reserved for immediate issuance on exercise of convertible debentures. | |

| (8) | Includes 50,000 shares reserved for immediate issuance on exercise of options. | |

| (9) | Includes 50,000 shares reserved for immediate issuance on exercise of options. | |

| (10) | Includes 50,000 shares reserved for immediate issuance on exercise of options. | |

| (11) | Includes 300,000 shares reserved for immediate issuance on exercise of options. | |

| (12) | Includes 300,000 shares reserved for immediate issuance on exercise of options. |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ADOPTION OF NEW ARTICLES OF THE COMPANY.5

PROPOSAL 3

1

INCREASE OF AUTHORIZED CAPITAL

The Company proposes to alter its Notice of Articles to increase the Company’s authorized capital from 100,000,000150,000,000 common shares without par value to 150,000,000an unlimited number of common shares without par value. The Company previously had also authorized 3,000,000 preferred shares without par value, however asand no preferred shares are presently outstanding, no preferred shares will be included in the proposed alteration.shares.

The Company currently has no specific proposals or agreements for offers or sales of its common shares. The Company expects that costs associated with developing a mine at its Soledad Mountain project may require additional equity financing. Any mine project financing or series of financings could result in the allotment of additional common shares that would exceed the Company’s current authorized capital. Accordingly, the Company believes that it is prudent to increase the authorized capital at this time.

The rights, privileges, preferences and restrictions applicable to the Company’s common shares will not be affected by the proposed change to the authorized capital. There are currently no provisions in the current or Revised Articles or agreements to which the Company is a party or is aware of, or any other facts or circumstances, that would give the Company a basis to conclude that the increase in authorized capital would have the effect of delaying, deferring or preventing a potential change in control.

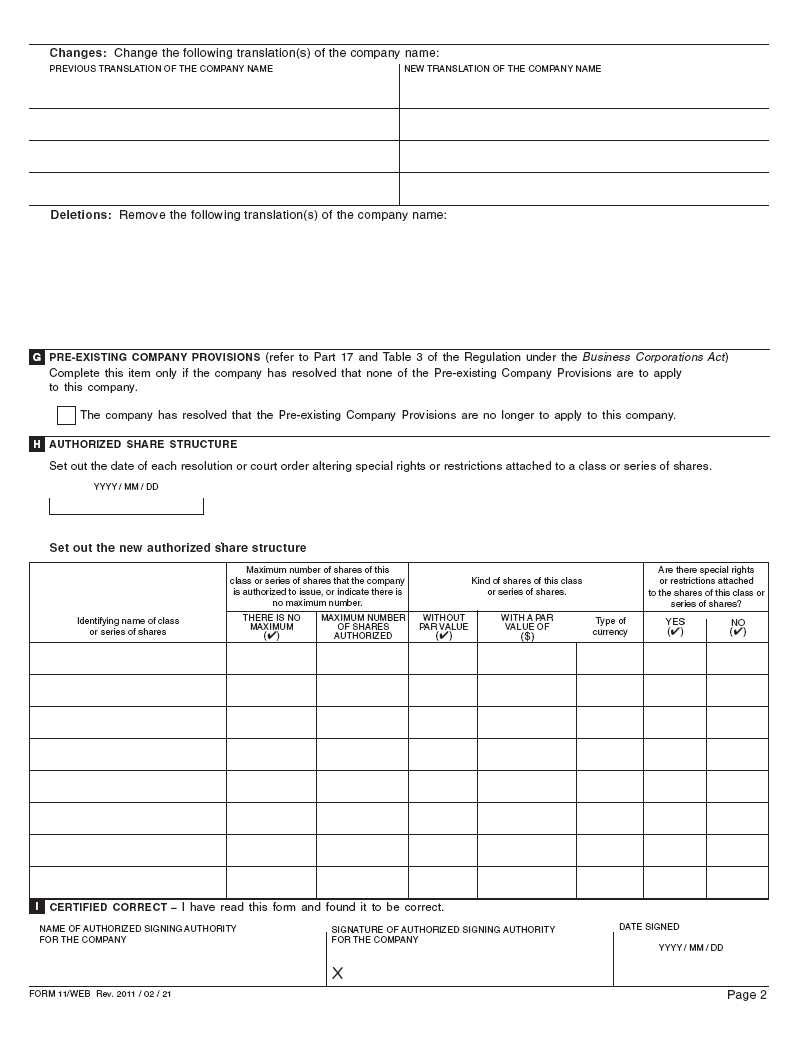

If shareholders of the Company approve the proposal to change the Company’s capital structure, the Company will file a Notice of Alteration, in the form attached hereto as Appendix “A”, with the British Columbia Registrar of Companies implementing the change in the Company’s capital structure.

The resolution to increase the authorized capital must be passed by not less than 75%2/3 of the votes cast by the shareholders present in person or by proxy at the Meeting. Accordingly, the Company’s shareholders will be asked to consider and, if thought advisable, to pass, with or without amendment, a special resolution as follows:

“BE IT RESOLVED, as a Special Resolution, THAT:

| (a) | the authorized capital of the Company be changed to | |

| (b) | any director of the Company is instructed to authorize its agents to file a Notice of Alteration to a Notice of Articles with the British Columbia Registrar of Companies along with all other necessary documents and take such further actions that may be necessary to effect the amendment; and | |

| (c) | the board of directors is hereby authorized, at any time in its absolute discretion, to determine whether or not to proceed with the above resolutions without further approval, ratification or confirmation by the shareholders.” |

7

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” INCREASING THE AUTHORIZED CAPITAL OF THE COMPANY TO 150,000,000AN UNLIMITED NUMBER OF COMMON SHARES.

OTHER MATTERS

Golden Queen knows of no other matters that are likely to be brought before the Meeting. If, however, other matters not presently known or determined properly come before the Meeting, the persons named as proxies in the enclosed proxy card or their substitutes will vote such proxy in accordance with their discretion with respect to such matters.

SHAREHOLDER COMMUNICATIONS

Shareholders can send communications to the Board of Directors by email at mintoexpl@telus.net or through our website at www.goldenqueen.com.

6

PROPOSALS OF SHAREHOLDERS

Meeting Materials sent to Beneficial ShareholdersOwners who have not waived the right to receive Meeting Materials are accompanied by a Voting Instruction Form (“VIF”). This form is instead of a proxy. By returning the VIF in accordance with the instructions noted on it, a Non-Registered Holder is able to instruct the Registered Shareholder how to vote on behalf of the Non-Registered Shareholder. VIF’s, whether provided by the Company or by an Intermediary, should be completed and returned in accordance with the specific instructions noted on the VIF.

In either case, the purpose of this procedure is to permit Non-Registered Holders to direct the voting of the shares which they beneficially own.Non-Registered Holders receiving a VIF cannot use that form to vote common shares directly at the Meeting - Non-Registered Holders should carefully follow the instructions set out in the VIF including those regarding when and where the VIF is to be delivered.Should a Non-Registered Holder who receives a VIF wish to attend the Meeting or have someone else attend on his/her behalf, the Non-Registered holder may request a legal proxy as set forth in the VIF, which will grant the Non-Registered Holder or his/her nominee the right to attend and vote at the Meeting.

Proposals which shareholders wish to be considered for inclusion in the Proxy Statement and proxy card for the 20112014 Meeting of Shareholders must be received by the Secretary of Golden Queen by December 1, 2010,2013, and must comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended, and Division 7 of Part 5 of the B.C. Business Corporations Act. After this date, any shareholder proposal will be considered untimely. If the Company changes the date of next year’s annual meeting by more than thirty days from the date of this year’s meeting, then the deadline is a reasonable time before the Company begins to print and mail its proxy materials.

ADDITIONAL INFORMATION

Additional information relating to the Company is available on the SEDAR website atwww.sedar.com. Financial information is provided in the Company’s comparative financial statements and management’s discussion and analysis for its most recently completed financial year, which will be available online atwww.sedar.com. Shareholders may request additional copies by (i) 6411 Imperial Avenue, West Vancouver, BC, V7W 2J5; or (ii) telephone to: (604) 921-7570.

Dated at Vancouver, British Columbia, this <>day of July, 2010.November, 2013.

8BY ORDER OF THE BOARD OF DIRECTORS

/s/ H. Lutz Klingmann

H. Lutz Klingmann

President

7